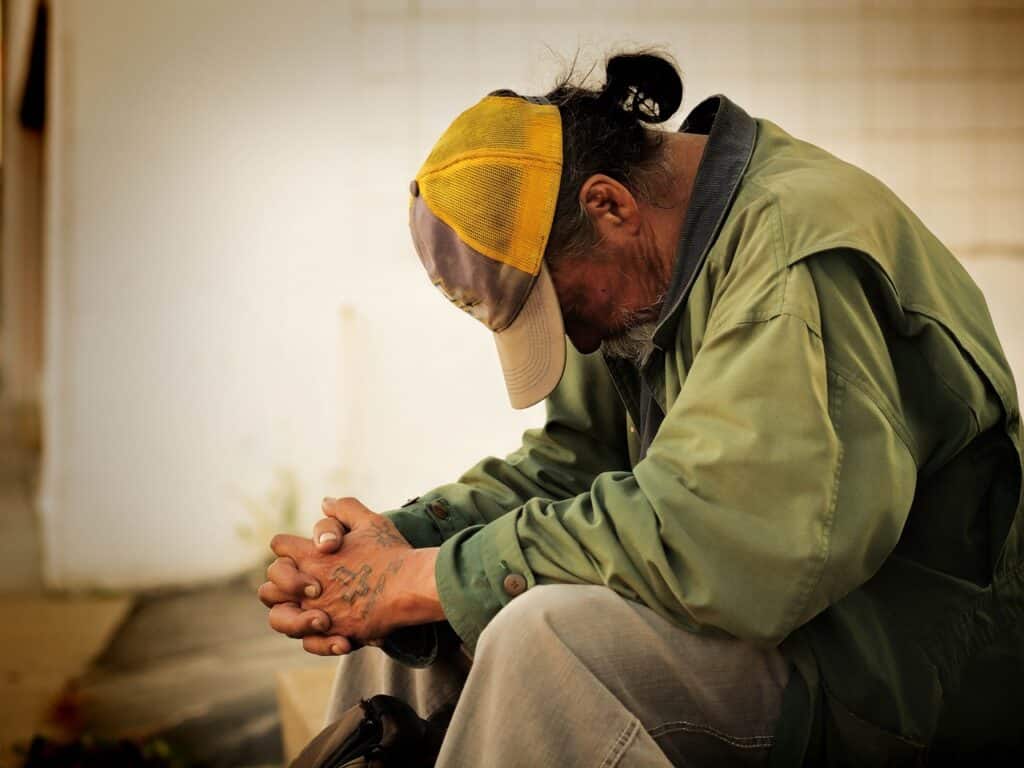

According to CBS news, 61% of Americans are living paycheck-to-paycheck. This can be problematic for a financial situation, as it creates unnecessary stress and uncertainty.

If you were to be in this situation, think about what that could mean. What would happen if next week’s paycheck never came in? What would happen if an unexpected emergency occurred? Or how about if you suddenly lost your job? All of these scenarios could easily lead to financial hardship.

What is living paycheck-to-paycheck?

Living paycheck-to-paycheck is a situation in which one is unable to meet financial obligations if they were to be unemployed. Basically, their paycheck is used to cover expenses with essentially no money left over. This leaves no room for savings, investments, or unexpected costs. It is a financial mistake that you should steer clear of.

Living paycheck-to-paycheck puts you at extreme financial risk. It can cause your credit score to drop as a result of missed payments, and could potentially lead to debt. This is a cycle that is hard to break free from. Thankfully, we will discuss how you can avoid this lifestyle.

How to avoid living paycheck-to-paycheck

If you are in this position, then it may be time to rethink your financial situation. There are various strategies that you can follow to avoid, or get out of, living paycheck-to-paycheck.

One way is to cut your spending. Maybe you spend more than you make, or your spending habits are reckless. Whatever it is that is leading to your overspending, it is time to stop. That fast food combo may not seem like such a big deal, but it can add up. Even just an extra $50 saved each week could lead to $2,600 saved annually. This can be used to give you breathing space and retain a more comfortable financial situation.

Another way is to create a budget. With this, consistency is key. A budget acts as a financial plan that can help you achieve your goals, such as paying off debts. Check your bank statement frequently, record how much you spend on a grocery trip, etc. Habits like this allow you to track your money and see what you are doing with your income. Ensure that your spending limit includes regular expenses, and is suited for your income.

The final method we will discuss is to increase your income. Easier said than done, right? Pursuing money-making opportunities and strategies can be the solution to your problem. This can mean asking for a raise, picking up an extra job, starting a side hustle, or getting external help.

Thank you for reading! Check out our other posts!